Sanctions

Sanctions are restrictive measures imposed by an international body, multilateral agency or a national government on other regimes,

organisations, vessels, aircraft or individuals; and may be widened through OFAC future revisions; with a view to achieving a desirable

outcome. The most widely known and applied sanctions are those imposed by the United Nations (UN). In addition to the international

sanctions there also exist sanctions imposed by regional bodies such as the European Union (EU). National governments may choose to use

their own national legislation to impose restrictive measures (or sanctions) against listed parties. Such measures may reflect the country’s

own foreign and security policy if these are imposed unilaterally or reflect international commitment if these are prepared in view of the

United Nations Security Council Resolutions.

What are financial sanctions?

What are financial sanctions?

Financial sanctions are an important part of foreign policy and support national security. They help to maintain the integrity of and

confidence in the UK financial services sector. Generally, they are imposed to:

• coerce a regime, or individuals within a regime, into changing their behaviour or aspects of it (‘offending behaviour ‘), by increasing the

cost on them to such an extent that they decide to cease the offending behaviour

• constrain a target by trying to deny them access to key resources needed to continue their offending behaviour, including the financing

of terrorism or nuclear proliferation

• signal disapproval of a target as a way of stigmatising and potentially isolating them, or as a way of sending broader political messages

to international or domestic constituencies

• protect the value of assets that have been misappropriated from a country, until they can be repatriated

Who imposes sanctions?

• The United Nations (UN) imposes financial sanctions and requires member states to implement them through resolutions passed by

the UN Security Council. The UN Security Council can decide to act to preserve or restore international peace and security under

Chapter VII of the UN Charter. Such sanctions may target governments of third countries or non-state entities and individuals (such as

terrorist groups and terrorists). They may range from comprehensive economic and trade sanctions to more targeted measures

comprising arms embargoes, other specific or general trade restrictions (import and export bans), financial restrictions, restrictions on

admission (visa or travel bans), or other measures, as appropriate.

• The European Union (EU) implements financial sanctions through EU regulations which have direct legal effect in the UK and all other

EU member states. Article 215 of the Treaty on the Functioning of the European Union (TFEU) provides a legal basis for the interruption

or reduction, in part or completely, of the Union’s economic and financial relations with one or more third countries (i.e., countries

outside the EU), where such restrictive measures are necessary to achieve the objectives of the Common Foreign and Security Policy

(CFSP). The sanctions imposed by the EU are either on an autonomous basis or implemented on the strength of binding resolutions of

the Security Council of the United Nations Sanctions. Where the sanctions are introduced on an autonomous basis, these reflect the

foreign and security policy of the European Union member states rather than that of the international community as evident in the

United Nations Resolutions.

• The United States Treasury’s Office of Foreign Assets Control issues US sanctions. They have a range of programmes in addition to

country-based regimes and also issue sanctions to specifically combat the trade of drugs through Counter Narcotics Trafficking

Sanctions. The Patriot Act introduced in October 2001 is the major piece of legislation that empowers certain US government agencies

to implement measures to enhance national security. The Office of Foreign Assets Control (OFAC) of the US Department of the Treasury

is entrusted with the enforcement of economic and trade sanctions and also responsible for the periodic publication of a consolidated

list containing the names and identification details of targeted foreign countries and regimes, terrorists, international narcotics

traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, threats to national security, foreign

policy or economy of the United States who are subject to financial restrictions.

• HM Treasury implements UN and EU financial sanctions through its Office of Financial Sanctions Implementation (OFSI) and makes

designations under domestic programmes. OFSI is the government agency in charge of implementing financial sanctions including

targeted asset freezes and restrictions on financial services. Breaches of UK financial sanctions are criminal offences, punishable upon

conviction for up to 7 years in prison. There are both civil and criminal enforcement options to remedy breaches of financial sanctions.

Law enforcement agencies may consider prosecution for breaches of financial sanctions. The monetary penalties regime created by the

2017 Act provides an alternative to criminal prosecution for breaches of financial sanctions legislation. OFSI can impose penalties for

sanction breaches of up to £1 million or 50% of the value of the breach – whichever is higher. “In 2016, just over one hundred

suspected breaches were reported to OFSI, 95 of which were actual breaches, totalling around £75 million.”

In addition to the above-mentioned sanctions regimes, Acuris Risk Intelligence also monitors other national or unilateral sanctions which

are enforced at national level. Individuals and entities featuring on such lists may not be flagged as sanction but are identified as being on

the local sanction list. This approach enables Acuris Risk Intelligence customers to easily distinguish between those who are subjected to

international sanctions and the local ones. For example this would include the following but is not limited to:

• Australia Department of Foreign Affairs and Trade – Listed terrorist organisations

• Belgium Federal Public Service – National financial sanctions

• Canada DFAT Consolidated List of Sanctions and OSFI Designated Individuals and Entities – Terrorism Financing

• China Ministry of Public Security Terrorist List

• France Individuals Subject to Asset-freezing measures

• Japan Ministry of Finance – Economic Sanctions

• Russia – Federal Financial Monitoring Service, Unified list of terrorist organizations

• Swiss State Secretariat for Economic Affairs – Terrorism list

The list above is simply an illustration of Acuris Risk Intelligence’s sanctions coverage and not intended to provide a full disclosure of all

sources regularly monitored by Acuris Risk Intelligence. For a full list of sanction lists screened by Acuris Risk Intelligence, please contact us.

Our approach

At Acuris Risk Intelligence we regard sanctions coverage as one our most important responsibilities given that sanctions are absolute

requirements depending on the jurisdictions where our customers are based and the currencies they transact in.

Our sanctions team is manned around the clock with a dedicated team of multilingual area specialists who monitors all sanctions for new

releases daily and on a rolling round-the-clock schedule as well as being subscribed to various news and email alerts issued directly by the

sanctioning bodies. Alongside the sanctions team, analysts and senior matter experts from the content team also screen local national

sources daily as well as a wide selection of regulatory bodies and watchlists from around the globe.

A wide range of sanctions websites are crawled by spiders and relevant content captured and delivered in dedicated queues for expedient

data processing.

Our content creation and update procedures are subject to strict auditable quality assurance procedures and every effort is made to avoid

errors, missing data fields or the duplication of profiles to ensure as a provider, we are timely and accurate in our gathering and sharing of

sanctions and regulatory enforcement content.

The level of detail for profiles of individuals and entities created in Acuris Risk Intelligence under the sanctions content category may vary

depending on what information the official list provides, but it does typically include: full names (including names in local script in case of

non-Latin alphabet, such as Chinese, Arabic, Cyrillic); date or year of birth for individuals; address(es); details of the type of offence;

evidence attached as a pdf article to all profiles. Each profile does also indicate that it is “Sanctions” content.

Our sanctions data consists not only of individuals and entities as standard but also designated vessels and aircraft and criminal and familial

organisations and associations. Within the data recorded are many searchable fields including International Maritime Organization

numbers, business registration numbers and dates, VAT numbers and aircraft model numbers and manufacture dates. All evidence is

documented within the profiles in an easily viewable pdf format and all former sanctioned profiles retained within the database as

previously sanctioned, with all evidence attached.

In terms of data acquisition, all sanction sources are screened daily and profiles created or updated promptly. The processing time for new

sanction releases varies depend on the number of names and the amount of information available for each profile; however, the

expectation is the update is completed in 30 minutes or up to 6 hours. In cases of existing sanction profiles where no new sanction data

was published, the automated review cycle is 6 months.

Regulatory Enforcement

The category “Regulatory Enforcement’ is the term used by Acuris Risk Intelligence to classify content typically derived from sources such

as:

• Financial and other regulatory authorities and disciplinary bodies (such as UK Financial Conduct Authority, China Securities Regulatory

Commission, Swiss Financial Market Supervisory Authority, Singapore Casino Regulatory Authority, etc)

• Law enforcement and anti-corruption agencies (such as Interpol, Europol, Hong Kong Police Force, etc)

• Additional lists included as part of the regulatory enforcement content are lists of individuals that have been disqualified as acting as

company directors (for UK only) as well as individuals who have been declared as bankrupt or insolvent (for UK and Ireland only).

This type of regulatory enforcement content is structured as a “list”, irrespective of whether the delivery format is pdf, xml, txt, html, csv or

else. The information is presented as a list of names of offenders (individuals and/or entities and their respective identification details),

subject to official regulatory enforcement action. Such content may include, but it is not limited to: fines, professional disqualifications,

licence suspensions or revocation for breaches of financial or other applicable laws and regulation, including gaming; investor warnings

related to unauthorised firms and activities; banned/de-barred firms; most wanted lists of fugitives from law, red alerts, watchlists, listings

of prosecutions and convictions etc.

Acuris Risk Intelligence’ content team consists of highly experienced, multilingual (from 3 to 10 languages) researchers who cover 240

jurisdictions in more than 40 languages, coming from either legal, media, politics and international relations, linguistics or economy and

finance background and have very good knowledge of political, financial, business and cultural affairs, including with respect to AML/CFT

legal framework. They act as the first point of contact and subject matter experts with regards to geographical area of responsibilities.

Regulatory Enforcement content is created and updated by multilingual area specialists who screen regulatory enforcement lists from

around the globe for new releases on a rolling schedule as well as being subscribed to various news and email alerts issued directly by the

sanctioning bodies.

The data acquisition model for Regulatory Enforcement Lists is aligned with the jurisdiction priority model (see section 4). The level of

ambition is that Regulatory Enforcement Lists for High Priority Jurisdictions are updated every other day, whereas for medium and low

priority jurisdictions, content creation and update ranges between three and five working days). For existing profiles where no new data

was published, the automated review cycle is aligned with the jurisdiction priority model and ranges between 9 months and 12 months. In

case of high volume data aggregated by spiders in queues as well as in cases of large amounts of data release on official websites, the time

required for updating the regulatory enforcement content in Acuris Risk Intelligence database may take longer. In such cases, special

measures (e.g. allocating additional resources on a temporary basis) are put in place to ensure that the content is being updated as soon as

possible.

PEPs, SOEs & Politically Exposed Businesses and Organizations

Politically Exposed Persons

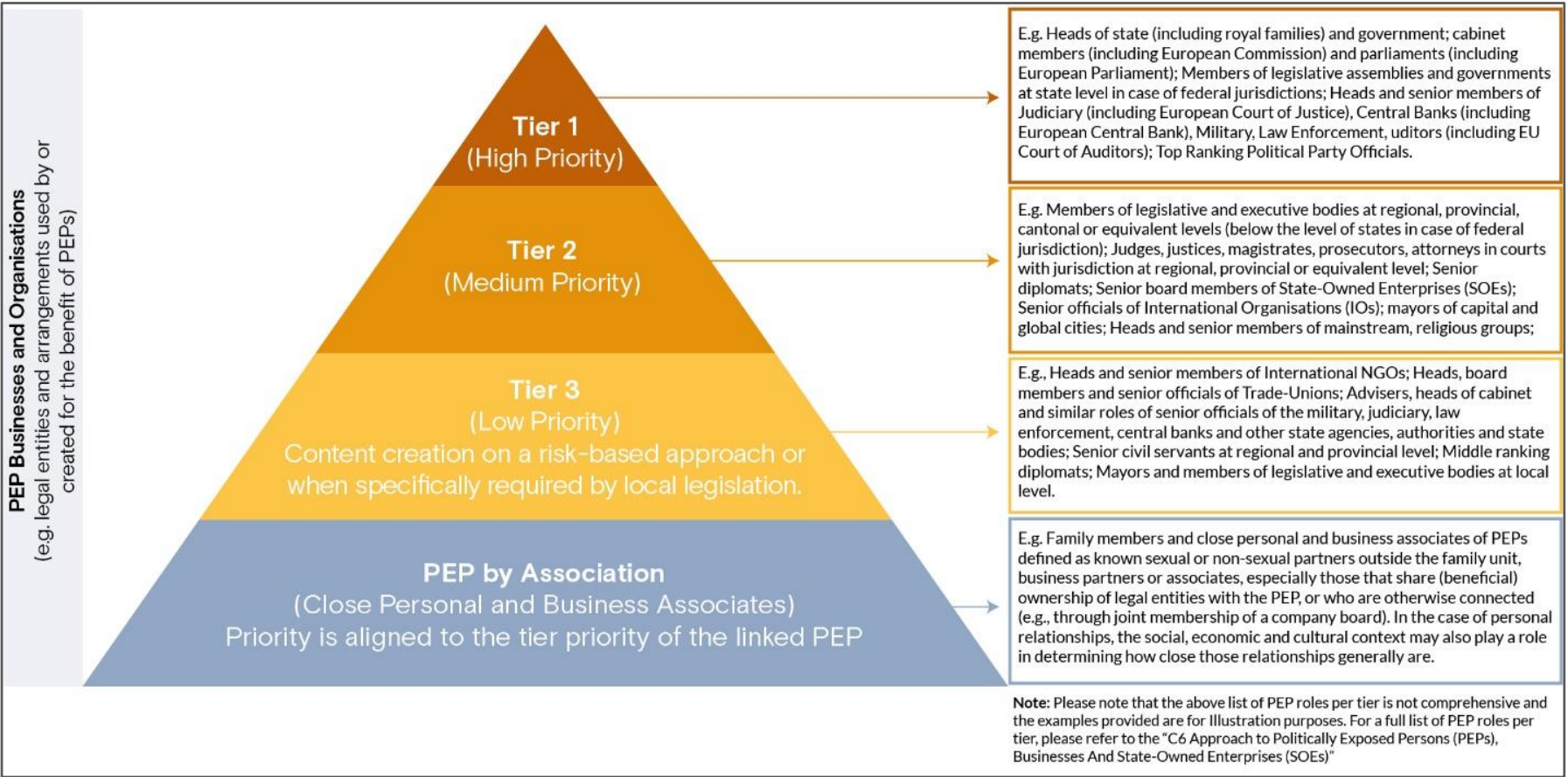

The general PEP Definition applied by Acuris Risk Intelligence is primarily based on the Financial Action Task Force (FATF) Guidance on

Politically Exposed Persons, but also draws from PEP definitions provided in the 5th EU Money Laundering Directive, the UK The Money

Laundering, Terrorist Financing and Transfer of Funds (information on the payer) Regulations 2017, the UK Financial Conduct Authority (FCA)

Finalised Guidance FG 17/6 on PEP definitions, the UK Joint Anti Money Laundering Steering Group (JMLSG) Guidance 2017 and the Wolfsberg

Group’s 2017 Guidance on Politically Exposed Persons.

In general, the term PEP refers to a senior public official, either elected or appointed, with substantial authority over policy, operations or

the use or allocation of government-owned resources. These may include: heads of states and governments, members of legislative

assemblies; senior officials in the executive, legislative, administrative, military, or judicial branch of a government; a senior official of a

major political party; senior executive of a government-owned commercial enterprise. The scope of the Acuris Risk Intelligence PEP content

also covers immediate family members of PEPs (meaning spouse(s), parents, siblings, children, and spouse’s parents or siblings) and any

individual publicly known to be a close personal or professional associate, as well as operating companies, trusts, personal investment

companies and similar vehicles where these are publicly known to have been established for the benefit of a PEP, or a family member or

close associate of a PEP.

While such definitions are valid sources of mandate for financial institutions to consider in defining an approach to compliance with

relevant regulations, Acuris Risk Intelligence believes they are not sufficiently detailed for its clients to verify and effectively process PEPs as

this treats all PEPs equally from a risk approach is not sufficiently granular from a ‘risk-based approach’. For this reason, Acuris Risk

Intelligence has set up in-house PEP Tiering guidelines that serve as the research framework for its Acuris Risk Intelligence content team to

follow consistently throughout their research and due diligence investigations. While several categories must be treated with care in certain contexts, the general guidelines should cover most governance systems spanning all jurisdictions in the world. In accordance with a

risk-based approach, the categories are divided into different priority levels, which also guides Acuris Risk Intelligence’s systematic data

development and maintenance procedures.

Note: Please note that the above list of PEP roles per tier is not comprehensive and the examples provided are for Illustration purposes. For a full list of PEP

roles per tier, please refer to the “Acuris Risk Intelligence Approach to Politically Exposed Persons (PEPs), Businesses and State-Owned Enterprises (SOEs)”

Politically Exposed Businesses and Organisations

Acuris Risk Intelligence PEP data model also accounts for the Politically Exposed Businesses. According to the FATF Guidance on Politically

Exposed Persons, the PEP could be either the account holder, or the beneficial owner of an account-holding legal entity. FATF states that

there is a risk that corrupt PEPs could circumvent AML/CFT and anti-corruption safeguards by opening accounts, establishing business

relationships or conducting transactions by using third parties, such as intermediaries, legal entities or legal arrangements.

The Wolfsberg Group guidance on PEPs (May 2017) clarifies, if a PEP is the beneficial owner or has requisite control of an operating

company or organisation, that person may be able to use the organisation in furtherance of corrupt purposes. For this reason, FATF

recommends that financial institutions should be required to have appropriate risk management systems in place to determine whether

the customer or the beneficial owner is a foreign PEP, or is related or connected to a foreign PEP, as well as taking reasonable measures to

establish the source of wealth and source of funds. Similarly, for domestic PEPs and international organisation PEPs, financial institutions

are recommended to take reasonable measures to determine whether such relationship exist and assess the degree of risk.

Consequently, Acuris Risk Intelligence’s approach to PEP identification and classification also maps out the relationship between PEPs and

legal entities and arrangements, either directly (as director, shareholder, or similar) or indirectly (as ultimate beneficial owner), where such

information is publicly known.

State-Owned Enterprises (SOEs)

With regards to State-Owned Enterprises, the Organisation for Economic Cooperation and Development (OECD) Guidelines on Corporate

Governance of State-Owned Enterprises refer to ‘… any corporate entity recognized by national law as an enterprise, and in which the state

exercises ownership. This includes joint stock companies, limited liability companies and partnerships limited by shares. Moreover, statutory

corporations, with their legal personality established through specific legislation, should be considered as SOEs if their purpose and

activities, or parts of their activities, are of a largely economic nature’. While this is a broad definition, capable of accommodating diversity

across jurisdictions it does not account for less clear-cut situations of more complex ownership structures. From the point of view of

complying with relevant Anti Money Laundering (AML) regulations, the way in which a SOE is defined has direct implication for the

classification of members of administrative, management or supervisory bodies of SOEs as PEPs. Likewise, corporate legal traditions in

various countries play an important role in determining the shape of the current corporate ownership and structure, such as the common

law system corporate legal tradition (UK, US, Commonwealth countries), Germanic Civil System corporate legal tradition, French Civil

system corporate legal system.

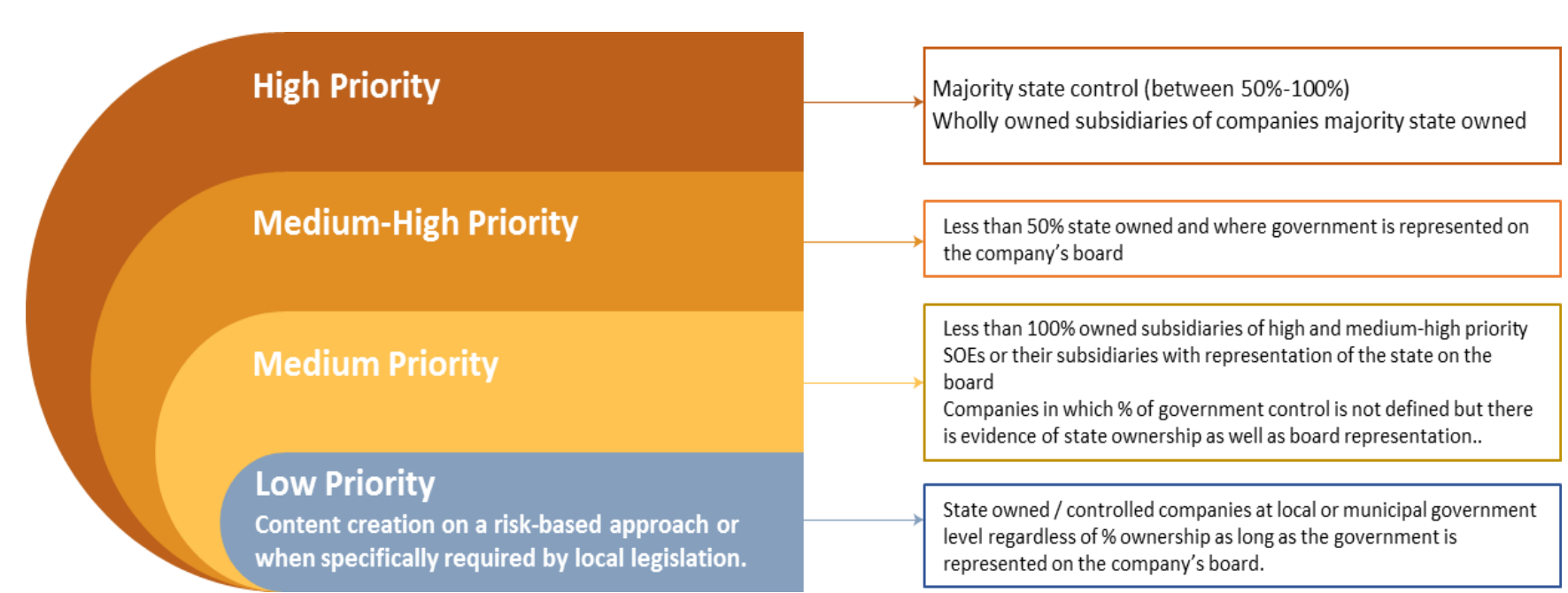

Given the above considerations, the approach followed by Acuris Risk Intelligence is based on two criteria:

• The extent of state control over a public enterprise through full, majority, or significant minority ownership;

• The formal representation of the state on the board of directors.

Based on the above a state-owned company can be defined as a SOE if:

• The state has a majority control of the enterprise (i.e. over 50%). These are strategically owned companies (but not necessarily majority

owned by any state) in which the state maintains an effective control for strategic reasons and where government officials are members

of the board of directors.

• The state has a minority control of the enterprise (i.e. between 10% to less than 50%.) and state officials are represented on the board.

This is a demarcation criterion instrumental when dealing with situations whereby the government invests in a business purely for

commercial reasons (i.e. to maximise return) but without having the intention to influence the operational management of company.

Hence, the relevance of significant state minority ownership will be determined in the context of state representation on the board of

directors.

For operational purposes, the following matrix guides the content creation according to the priority level assigned to each SOE: